On December 7, Director of Pingan Insurance Wu Jinjiang visited PHBS to speak about the factors to be considered when purchasing insurance products. Invited by the Risk Management and Insurance Research Center (RMIRC) of Peking University HSBC Business School, Wu is also a Registered Financial Consultant (RFC). He addressed more than 70 MBA students during his presentation.

First, Wu looked back on the development of China’s Insurance industry and pointed out the huge potential in its future growth. He said that accompanied by wealth accumulation, the role of insurance in individual asset allocation is becoming more and more important, and an increasing number of people who used to take a passive attitude toward insurance now purchase it actively.

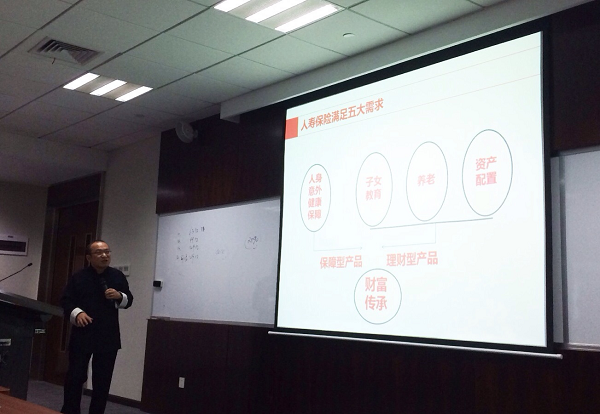

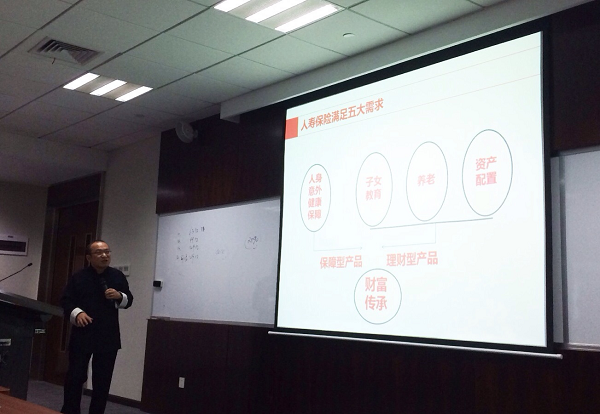

Next, Wu suggested that when purchasing insurance, we need to put the primary function of insurance – providing protection – in the first place, and then consider its investment function. Further, we should allocate assets efficiently in a way that takes different stages of life into account. For instance, when we first enter the labor markets without much wealth, Wu said we should buy insurance products that aim at protecting ourselves against accidental injury and major diseases. As age and wealth increases, finance-type insurance products that maintain your wealth should be taken into consideration, like dividend payment, children’s education insurance and retirement plans. Wu said that with great wealth, asset allocation, tax and debt avoidance become of importance and insurance can serve this purpose. Therefore, its proportion in individual total assets should be increased. Wealth inheritance can also be achieved by insurance. Generally speaking, Wu said, the insurance amount can be set at five to ten times of annual income and should account for around 10 to 20 percent of individual assets or even more.

The audience asked questions concerning the difference between mainland and Hong Kong insurance, the development of Internet insurance, the difference between rate of return on investment and a policy’s actual rate of return, and more. Wu provided a detailed answer to the questions one by one, which helped students better understand the function of insurance. In addition, the “Three Ma’s” were also heatedly discussed -- Ma Yun (Alibaba), Ma Mingzhe (China Pingan), and Ma Huateng (Tencent),who have jointly launched a property insurance company.

Written by Xia Lu, Translated by Zheng Yuxin 14'