Editor's note: Wall Street Rewards CEOs Who Talk About Their Strategies is recently published on

Harvard Business Review. It is coauthored by Richard Whittington, Basak Yakis-Douglas, and Kwangwon Ahn. Graduated from Oxford University,

Kwangwon Ahn is an Assistant Professor of Finance at Peking University HSBC Business School, with a research focus on Asset Pricing, Computational Economics and Macroeconomics.

By Richard Whittington, Basak Yakis-Douglas and Kwangwon Ahn

Conventional wisdom says investors dislike uncertainty. A CEO succession presents a time of enormous corporate uncertainty — and thus a time when investors may become especially skittish.

But our research shows that new CEOs can allay investors’ fears by talking about their strategic plans for the company. For example, when Daniel Zhang, the new chief executive of Chinese ecommerce giant Alibaba, talked about his proposed new “Let’s Go Global” strategy one week after his appointment, the company’s stock price rose immediately by 1%, the equivalent of $2.2 billion, with further rises in the following days.

We studied the effects on stock prices of more than 900 public presentations on strategy by the CEOs of leading American companies. These presentations involved plans regarding strategies such as internationalization, innovation, and diversification. We excluded presentations that included announcements of actual events (such as an acquisition) or were given the same day as earnings announcements or forecasts. We saw that such presentations have significant effects on stock value — effects that were magnified for new CEOs, and new outsider CEOs in particular.

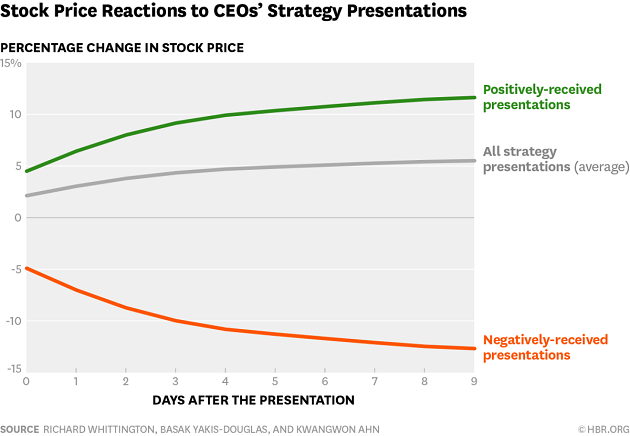

Overall, we found that investors do indeed like the information contained in strategy presentations. The average stock value rise on the same day as these strategy presentations was just over 2%, corresponding to approximately $1.1 billion gain in market value. As the middle line on the chart below indicates, the positive bounce continued for several days, reaching about 5% four days after the initial presentation day.

And yet we did find quite a range among these presentations. We split the whole sample into three groups: those that achieved a statistically significant positive reaction, those for which the reaction was significantly negative, and those for which there was no significant reaction. We found that across our whole sample, more strategy presentations gained significant positive stock price reactions (34%) than negative (26%), with the remainder not making much difference. For those that received significant positive reactions, stock prices moved up 4.5% on presentation day, or around $2.4 billion in average market value (the top line in the chart). Stock prices continued to drift upward for several days afterward, registering gains of above 10%.

For the smaller group of organizations that received unfavorable reactions, presentations were associated with an average drop in stock price of around 4.9% on presentation day, amounting to a loss of $2.6 billion per company (the bottom line in the chart). For instance, when Twitter CEO Jack Dorsey admitted to investors that he didn’t yet have a strategy, he wiped $4 billion off his company’s stock value in a couple of days.

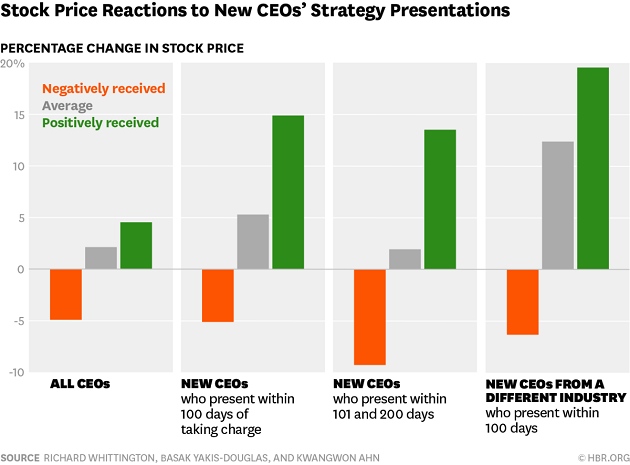

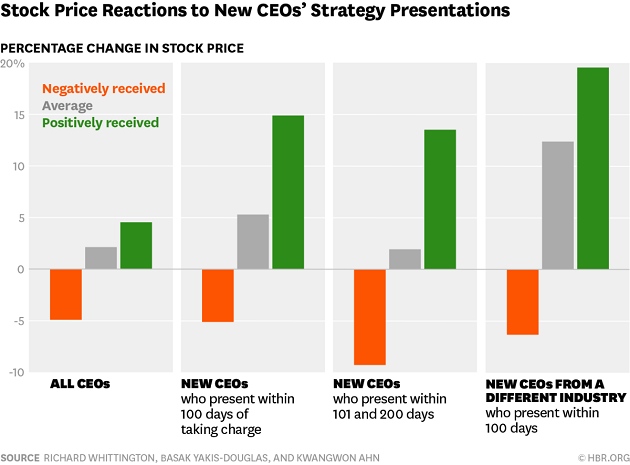

For new CEOs who open up to investors, the impact of publicly discussing their strategies was even greater. For new CEOs that present their strategy within the first 100 days of their appointment, average stock price reactions on presentation day were around +5.3% ($2.8 billion), better than for CEOs overall. For the statistically significant positive group, these gains were as large as 14.9% ($7.9 billion), much better than for CEOs as a whole. For those that were negatively received, markdowns were around 5% ($2.7 billion).

This second chart has important implications for when CEOs should present their strategies and who should be keenest to present. First, new CEOs should not wait too long to make their first strategy presentation. The longer new CEOs wait, the smaller the positive effects. On average, investors’ reactions to new CEOs’ strategy presentations who wait between 101 and 200 days was far lower than those associated with earlier presentations: around 1.9% ($1.1 billion). Late presentations received positively achieved nearly as favorable reactions as those by faster new CEOs, 13.5% ($7.2 billion). But for the negatively received presentations there were severe consequences, with losses of around 9% ($4.8 billion). The potential downside for new CEOs is thus particularly high if they delay.

Second, the less familiar new CEOs are to the firm’s existing investors, the greater the potential upside to strategy presentations. We took as extreme examples of unfamiliarity the 10% of our new presenting CEOs who were appointed both from outside their firms and from outside their firms’ principle industry (as, for instance, Burger King did when it hired Daniel Schwartz as its new CEO straight from Wall Street). These unfamiliar new CEOs received much more positive presentation-day reactions, with overall average upward bounces of 12% ($6.6 billion). Among the subgroup of positively received presentations by industry and firm outsiders, the bounce was nearly 20% ($10.4 billion). The downside for the negatively received presentations by these unfamiliar CEOs was hardly greater than for all new CEO presentations.

All chief executives should consider being more open about their strategies. Investors do take their strategy presentations seriously. But new CEOs should be particularly willing to tell the world about their strategies, especially if they are not well known to existing investors. To maximize the benefits, new CEOs should not wait too long.

From Harvard Business Review (HBR)

HBR is a general management magazine published by Harvard Business Publishing, a wholly owned subsidiary of Harvard University. It has been has been the frequent publishing home for scholars and management thinkers such as Clayton M. Christensen, Peter F. Drucker, Michael E. Porter, Rosabeth Moss Kanter,etc. HBR's articles cover a wide range of topics that are relevant to leadership, organizational change, strategy, operations, marketing, and finance.