By Annie Jin, PHBS Media and PR Office

Along the northern rim of Hong Kong Island, Queen's Road makes its way through the high-end financial district, where, among other notable institutions, Goldman Sachs’s Asia headquarters is located. And one of Peking University HSBC Business School’s (PHBS) newest faculty members once went to work there for three years. Now an assistant professor, Jaehyuk Choi, who joined the faculty last fall, recalls the career path that brought him here.

Said Choi, “Dealing with numbers was actually quite easy for me.” A self-described “science kid,” Choi earned his bachelor’s degree in mathematics from the Korean Advanced Institute of Science Technology (KAIST) and then pursued his Ph.D. in applied mathematics at the Massachusetts Institute of Technology (MIT).

After graduation, Choi worked at the New York office of BNP Paribas, one of the largest banks in the world, for close to two years. Then he joined Goldman Sachs as a quantitative analyst, commonly known as a “quant,” and after nine years of work in New York and Hong Kong, he made a surprising career shift leaving his position as the vice president of the firm's Securities Division to pursue academic life as an assistant professor at PHBS.

Professor Choi is preparing for the courses at his office

“For me, it’s a natural return,” said Choi, sitting in a black chair at his PHBS office. On the wall behind him hangs a whiteboard with math formulas and equations scrawled on it. As the interview started, the clock ticked 3:00 pm, the busiest time for the financial market, when just a year ago, he would have kept track of market moves on a trading floor.

Market is everything

“At Goldman, I was mostly tied to the market hours,” Choi said as he put a load of academic papers next to his computer. He added that “basically, life is very, very busy.”

Choi worked for the security division, which houses the bank's fixed income, currencies, and commodities units (FICC). According to

Business Insider, that FICC remains critical to Goldman's profitability, as it once represented the largest portion of the firm’s revenue pool in recent years.

His love for and strength in math served as a plus for his career at the top financial giant, throwing him into a life rigidly following the edict to oversee and analyze market signals. Choi rarely deviated from his daily schedule: he arrived at his office at 8:00 a.m. and double-checked risk analysis and reports. If he detected any problems, then he had to fix things quickly before market opens.

During market hours, Choi said that he had to compute the prices for upcoming trades, give traders quick responses, and then make risk reports. In addition to the market-driven activities, his quant team also shouldered model researches, since it is also critical to improve the models applied to trading and risk analysis. Said Choi, “They’re long-term projects. I had to have a careful plan to make small progress every day. ” For him, the biggest challenge of the quant job actually lay in balancing between the tasks with completely different cycles of time.

At Goldman, “strats”, another name for quants used in the firm, are considered intellectual superstars. The global team that Choi worked with, depending on the issue, included 10-15 people in Asia and 40-50 from New York to London. Of course, dealing with different time zones was a challenge, but Choi joked that they had “formulated a precise global schedule.” “Due to the time lag, we had to schedule conferences quite late between 8 or 9 p.m. So, working overtime is quite normal,” Choi said, adding that “the good thing is that the decision-making process is quick. We just discussed and would strike a deal. That’s it.” With no need to stay up late writing conference memos, he could leave some time to do some research work.

With a desire to do fundamental research, Choi has published several papers in key international academic journals, for instance, in

Mathematical Finance and

Applied Mathematical Finance. His research fields include quantitative finance, mathematical modeling, and data science. However, as compliance in financial industry is quite strict, Choi said if he wanted to speak at a conference, his presentation had to go through a complicated pre-approval process. “After financial regulation recently has become very strong the opportunity to do research on new models and new products almost disappeared.”

Facing those constraints, Choi said, “I finally decided to come back to academics."

Return to academia

It was over conversations with Seungjoon Oh, a KAIST alumnus and PHBS assistant Professor, when Choi first learned about PHBS.

Located in China's first Special Economic Zone, and adjacent to the Asian financial hub of Hong Kong, PHBS has an ideal setting for studying the advances in finance, economics and management, where the full-time MA and MBA programs are conducted in English. The school has over 60 full-time faculty members of which nearly half are international. More than 95% of PHBS faculty earned their Ph.D. from overseas top universities.

PHBS Building

Among the nine faculty who joined PHBS last fall, Choi is the only one with over ten years’ experience at a top financial institution. Though with a strong background, he found making a shift from industry to academia is not that easy, admitting that in most cases, schools only invite industry experts to teach some courses, not hire them as full-time faculty, due to their lack of teaching experience or academic achievements. “In addition to the two benchmarks for candidates, PHBS also sets an eye on practical skills and academic potential.”

As a new professor, Choi said that he “spares no expense” to prepare lectures, reading the latest academic materials and trying to know more about students’ background. “Though my courses cover pretty much the same stuff as my work experience, teaching is still challenging.” With his courses focusing on quantitative finance, he also incorporates machine learning in this module.

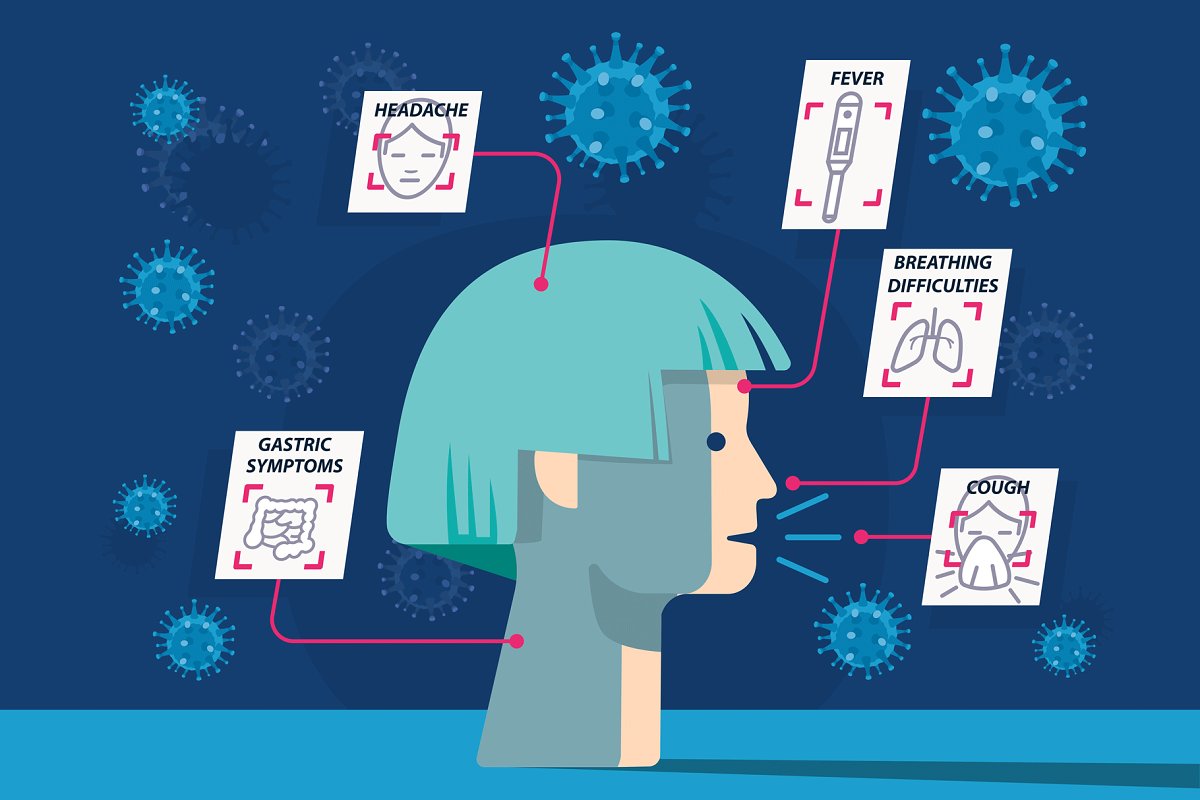

The past two years have seen the rise of artificial intelligence (AI) and machine learning (ML) which are finding their way into the financial industry. It is reported that although some may argue that many of the new AI-focused hedge funds will probably go nowhere, Goldman Sachs is investing deeply in the field of Fintech. “I want students not to be afraid of ML,” Choi said. “The basic principle is easy. If you know about mathematics, probability and statistics, then you already know many things about ML.”

Apparently, students were not that afraid to learn about ML, as about 18 registered for Choi’s course. “I expected like 3 or 4, and even worried about whether this course would open.” He said that for the final course project, each student selected one data set to employ ML methodologies to do in-depth analysis. In addition, Choi has been trying to approach the issue from the business side, since many tech and financial companies are using ML or AI to boost revenues.

“Some students think it’s too difficult, but some say I should go into the theory deeper.” Choi said that since his course involves many models, data analysis and coding, those without strong math skills might find it difficult. In addition to teaching, Choi leaves most of his time for academics on the research side of his new academic life. He has been delving into the fields of applied mathematics and finance engineering and plans to focus on Fintech. Most recently, he has been working on the Black-Scholes-Merton models under multi-asset framework and an efficient pricing method for stochastic volatility models.

Future career choices

“It’s natural, as business students want to look for high-paid jobs,” commented Choi, when it comes to future career choices.

According to the PHBS 2016 Employment Report, about 95% of graduates enter the job market, and only 4% pursue doctoral degrees. Among the 240 students who went to work, 53% initiated their careers in the investment banking sector and securities. However, if students don’t align themselves to the types of jobs that fit who they are, then they might get trapped in herd mentality or “going along with the crowd, “influenced by others’ ideas of what “good jobs” are.

As an example, Choi pointed out that ten years ago, South Korean youngsters wanted to be fund managers and investment bankers because leading characters in Korean TV dramas often took portrayed such positions. “Graduates may not like the actual jobs, but they can always stay open to other jobs.” He cited his experience, arguing that working at a top financial firm could also serve as a stepping stone for young peoples’ future careers.

For students focused on academics, Choi suggested that they should follow current trends, keep track of the market and find issues they want to work on, making research step out of the “ivory tower” to impact the real world. For instance, commenting on his interest in how high-tech is reshaping China’s financial industry, Choi remarked that he is amazed at how widely WeChat pay is used and plans to look into China’s unique credit pattern.

Choi further addressed the trend, Fintech, “where technology and finance meet.” It’s often said that Fintech, especially AI, seems to be on the lips of many practitioners and viewed as a potential threat to many financial jobs. However, Choi believes an AI-driven platform is just a replacement for some industry analysts, as it can input basic financial information and automatically generate reports, but it typically serves as a cooperative robot to help quants formulate complicated investments strategies.

“Since PHBS is located in Shenzhen, China’s cradle of high-tech innovation, we can prepare students to know more about tech firms and get must-have skills related to AI and ML,” remarked Choi, who maintained that as long as finance or economics graduates follow the trend, they will not slip into an inferior position, fearing that they will be outcompeted by AI. “Leveraging its’ location, I think PHBS and Shenzhen will grow together in a similar way as Stanford university and Silicon Valley did.”

On top of that, Choi said that PHBS students are equipped with knowledge of economics, finance and management, which can also be assets in any tech company, mentioning that firms in Silicon Valley are hiring economists at a rapid clip. However, “tech companies are now hiring top-level economists, not new graduates,” so Choi points out that tech industry is not as a good alternative in the near future for graduates compared to Fintech. “Only when the trend for tech firms hiring economists becomes pervasive could our students have the great potential to be the best candidates in the tech industry.”

MIT Nerd Pride Print

Choi recalled his days at MIT, where “Nerd Pride” turned MIT students into more independent individuals, not just following the textbooks and professors. “Being a nerd means doing something unique in your own way,” he said. So, Choi advises students to divorce themselves from the crowd when embarking on their careers. “The key is to pursue what really intrigues you.”

By Annie Jin

Edited by Priscilla Young

photographer: Feng Xie