Crowdfunding serves as an online mechanism enabling entrepreneurs to access funds from individuals worldwide. This method of financing startups is gaining popularity alongside traditional funding avenues such as venture capital and bank financing. According to a QYResearch Report, the global market size for crowdfunding was approximately USD 12.27 billion in 2019, and is projected to reach USD 25.80 billion by the end of 2026. Various forms of crowdfunding campaigns exist, including reward-based, equity-based, debt-based, and donation-based campaigns. In “Quality Signaling through Crowdfunding Pricing,” a paper published by

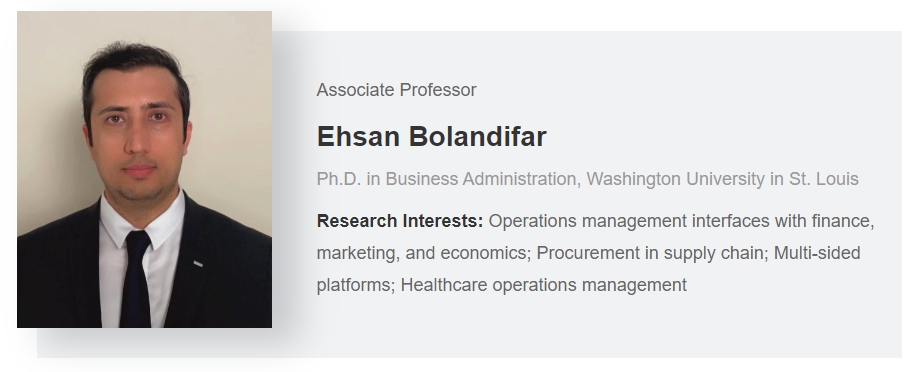

Manufacturing & Service Operations Management, PHBS Associate Professor Ehsan Bolandifar and his coauthors concentrate on reward-based crowdfunding, the most commonly practiced form, investigating how entrepreneurs can leverage their pricing strategy to signal a high-quality project. Reward-based platforms like Kickstarter and Indiegogo have been exceptionally successful, raising billions of dollars for entrepreneurs in the past decade.

In a reward-based crowdfunding campaign, an entrepreneur seeking funding for a project initiates a campaign on an online platform presenting the project's details, funding goal, and financing target. Participants on these platforms can support the campaign by making online preorders and payments. The campaign runs for a specified period (usually several weeks or months), and achieves success if the funds collected surpass the announced financing target. In case the target is not met, the campaign fails and the platform returns the raised funds to backers. The funds acquired through a successful campaign are utilized for establishing the business, which may involve activities such as hiring labor, procuring materials, and manufacturing the final product.

In a crowdfunding campaign, customers determine whether to back the project based on their perceptions of the product's quality. While entrepreneurs possess accurate knowledge of their product's quality, potential backers during the funding period can only form their beliefs based on the quality level of the project based on the information released on crowdfunding platforms, such as online demos, pictures, and descriptions. Unfortunately, in practice, there have been numerous instances of quality issues being reported after customers received their preordered products, leading to fundraisers failing to deliver on their promises to backers.

As customers' beliefs about product quality significantly influence their decision to support a campaign, entrepreneurs must find ways to establish credible signals of their product's quality. Research has shown that the success of crowdfunding efforts is linked to the underlying quality of the project. Visual techniques, for instance, have been utilized effectively as signaling methods to convey product quality to potential customers. Nevertheless, it should be noted that such signaling methods may lack complete credibility and may not be entirely foolproof.

Our initial discovery indicates that setting a sufficiently low funding price can serve as a signal of high quality for customers during the funding period, particularly when the project's financing needs are not substantial. When comparing high-quality entrepreneurs to those of lower-quality (who imitate high-quality), the former have better prospects during the regular selling period due to their revealed high quality. Consequently, any alterations in the funding price have distinct indirect effects on these two types of entrepreneurs.

Specifically, Bolandifar and his coauthors demonstrate that a downward distortion in the funding price has a more substantial positive impact on the high-quality entrepreneur's profit (by increasing the likelihood of entering the regular selling period and the expected profit associated with it) than on a mimicking low-quality entrepreneur. As a result, this distortion reduces the signaling cost for high-quality entrepreneurs, especially at lower funding prices, enabling them to effectively signal their quality through an appropriately low funding price.

Furthermore, they demonstrate that through price commitment, entrepreneurs can effectively signal their quality across a broader range of financing needs when compared to using a single fixed price for signaling. When the degree of information asymmetry (i.e., the difference in potential quality levels) is relatively small, the high-quality entrepreneur strategically deviates the funding price from the optimal value observed in the full-information scenario and also adjusts the regular selling price to signal their high quality.

To achieve this two-price signaling strategy, the high-quality entrepreneur commits to a higher regular selling price, which imposes a significant opportunity cost on a low-quality entrepreneur attempting to imitate the high-quality signal. The high-quality entrepreneur further magnifies the expected opportunity cost for the mimicking low-quality entrepreneur by lowering their funding price, as a reduced funding price increases the likelihood of entering the regular selling period in our model. This combination of price distortions effectively reduces the signaling costs for the high-quality entrepreneur in crowdfunding contexts.

Finally, their research shows that as the degree of information asymmetry increases, a downward distortion in the funding price alone might suffice to signal a high-quality level effectively. In contrast, the two-price signaling approach becomes more advantageous when there is less disparity in potential quality levels.